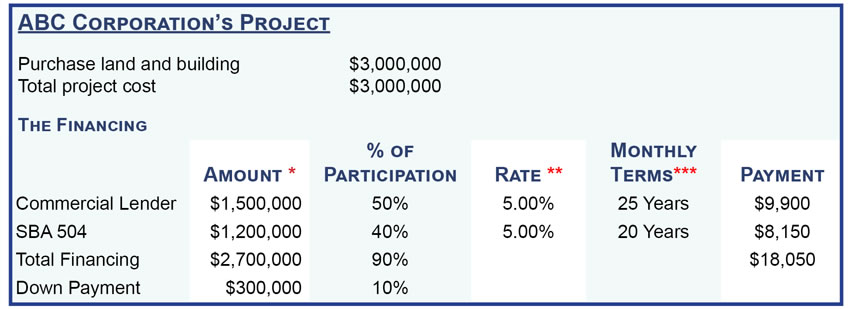

ABC Corporation has been leasing their building for five years and has now decided to buy their own building. A building that fits their needs is available for $3,000,000. ABC’s owner wants to make an offer, but he does not have the 25% ($750,000) down payment that would be required with conventional financing. He discusses the options with his commercial lender, who offer the perfect solution – an SBA 504 loan.

* Loan amounts and down payments vary with project type and credit quality. 504 loan maximum is up to $5 million ($5.5 million for manufacturers & Green Energy Projects).

** Bank rates vary by lender. The 504 rate is set at the time of loan funding, approximately 60 days after loan closing,

*** Bank loan has minimum 10-year term and 10-to-20 year amortization. The 504 loan is a 20-year fully amortized loan and payments are estimated.

Notes:

- Both loans use the same appraisal and environmental reports.

- The lender provides interest-only bridge financing until the 504 loan funds.

- Small business must meet conventional credit underwriting criteria.

- SBA 504 loan program fees are approximately 3% of the loan amount and built into the fixed long-term interest rate.